Have you ever wondered who owns a company? The answer lies in something called stockholders equity. It is the part of a company that belongs to its owners, the people who hold its stock or shares. This article will help you understand stockholders equity in a simple way. We will also explain related terms like shareholders equity and owner’s equity. By the end, you will know why this is important for anyone interested in business or investing.

What Is Stockholders Equity?

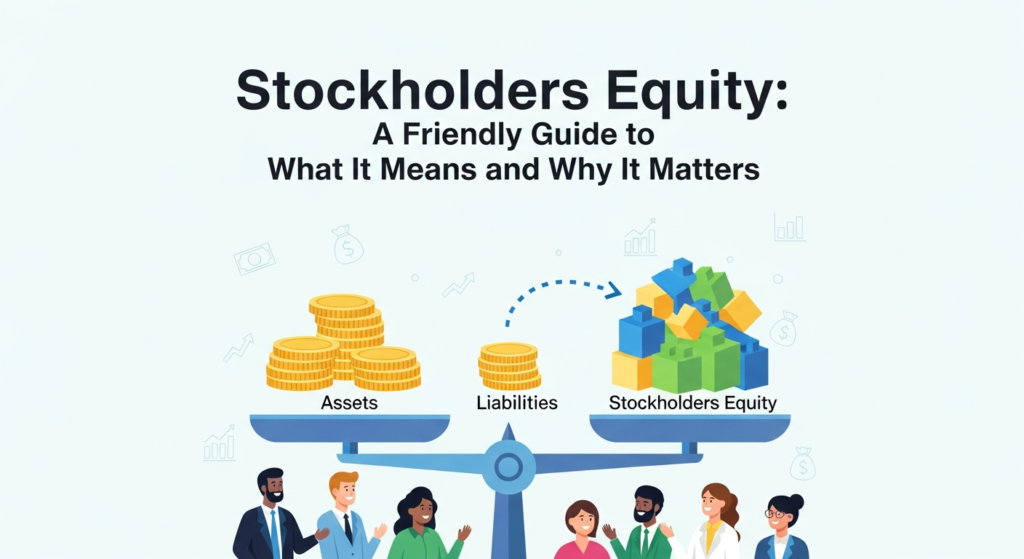

Stockholders equity is the total value of a company that belongs to its shareholders. Imagine a company as a big pie. The pie represents everything the company owns (its assets). When you take away what the company owes (its liabilities), what is left is stockholders equity. It shows the true value of the company for its owners.

Difference Between Stockholders Equity and Shareholders Equity

Many people use the terms stockholders equity and shareholders equity interchangeably. Both mean the same thing — the ownership value of people who own shares in a company. Whether a company calls its owners stockholders or shareholders depends on the company type, but the meaning is the same.

Owner’s Equity vs Stockholders Equity

Owner’s equity usually refers to the owner’s part of a small business or partnership. For bigger companies, which have many owners called shareholders, the term stockholders equity is used. Both terms mean the value left in a business after subtracting liabilities from assets.

How Is Stockholders Equity Calculated?

The formula for calculating stockholders equity is simple:

Stockholders Equity = Total Assets – Total Liabilities

If a company owns $1 million in assets and owes $400,000, the stockholders equity is $600,000. This number is important because it shows the net worth of the company from the owners’ point of view.

Why Is Stockholders Equity Important?

Stockholders equity tells us if a company is financially healthy. If the equity is positive and growing, it means the company is doing well and increasing value for its owners. Negative equity means the company owes more than it owns, which can be a warning sign.

Components of Stockholders Equity

Stockholders equity has a few parts:

- Common Stock: The money shareholders invest when they buy stock.

- Retained Earnings: Profits kept by the company instead of paid out as dividends.

- Additional Paid-In Capital: Extra money paid by investors above the stock’s face value.

- Treasury Stock: Shares the company has bought back from shareholders (this reduces equity).

Stockholders Equity on the Balance Sheet

You can find stockholders equity on a company’s balance sheet. The balance sheet lists assets, liabilities, and stockholders equity. This snapshot helps investors see the company’s financial position at a certain time.

How Stockholders Equity Affects Investors

For investors, stockholders equity shows the company’s real value. A rising equity usually means the company is growing and profitable. It also affects the price of the stock and potential dividends paid to shareholders.

Stockholders Equity and Dividends

Companies often share profits with stockholders as dividends. The size of dividends can depend on the stockholders equity and retained earnings. Strong equity can mean more money to pay shareholders.

Real Example: Apple’s Stockholders Equity

Let’s look at a real company. Apple Inc., one of the biggest companies, has billions of dollars in stockholders equity. This means after paying debts, Apple has huge value for its shareholders. Investors watch this number to decide if Apple is a good company to invest in.

FAQs About Stockholders Equity

1. Is stockholders equity the same as company value?

Not exactly. Company value can include market value, but stockholders equity is the net value after liabilities.

2. Can stockholders equity be negative?

Yes, if liabilities are more than assets, equity is negative, which is risky.

3. How often does stockholders equity change?

It changes with profits, losses, new stock issues, and dividends.

4. Does stockholders equity include debt?

No, debt is subtracted to find stockholders equity.

5. Why do companies buy back shares (treasury stock)?

To reduce shares available and increase value for remaining shareholders.

6. How is retained earnings part of equity?

It is the accumulated profit kept in the company for growth or debt payment.

Conclusion: Why Understanding Stockholders Equity Matters

Knowing about stockholders equity helps you understand a company’s true value. It shows what belongs to the owners after debts are paid. Whether you want to invest or just learn about business, this knowledge is key. Keep an eye on stockholders equity to see how companies grow and stay healthy. If you found this helpful, share it with friends or ask questions below!